Algorithmic Trading Python Library

Implementing the stochastic oscillator in python offers many advantages in algorithmic trading. This library is amazing but looks complicated a little.

What Are The Best Algo Trading Libraries Quora

Algorithmic Trading with Python a free 4-hour course from Nick McCullum on the freeCodeCam YouTube channel.

Algorithmic trading python library. To get started with PyAlgoTrade take a look at the tutorial and the full documentation. Photo by Dominik Scythe on Unsplash. Pandas is a vast Python library used for the purpose of data analysis and manipulation and also for working with numerical tables or data frames and time series thus being heavily used in for algorithmic trading using Python.

And live trading is now possible using. Python machine-learning trading feature-selection model-selection quant trading-strategies investment market-maker feature-engineering algorithmic-trading backtesting-trading-strategies limit-order-book quantitative-trading orderbook market-microstructure high-frequency-trading market-making orderbook-tick-data. Python utilises NumPySciPy for such computations.

Algorithmic trading relies on computer programs that execute algorithms to automate some or all elements of a trading strategy. This indicator serves as a momentum indicator that can help signal shifts in market momentum and help signal potential breakouts. It describes the current price relative to the high and low prices over a trailing number of previous trading periods.

Before starting the mathematical concepts of algorithmic trading let us understand how imperative is maths in trading. PyAlgoTrade is an event driven algorithmic trading Python library. Google Colab No need to do lengthy tedious Anaconda installs to run Jupyter Notebook on your laptop All you need is a Gmail account.

The stochastic oscillator is a momentum indicator used to signal trend reversals in the stock market. Python Algorithmic Trading Library. Learn to calculate it using the numpy library.

And before that let us take a look at two important components of the same which is a Trader and a QuantQuantitative Analyst. He is currently working on cutting-edge Fintech projects and creates solutions for Algorithmic Trading and Robo Investing. The Moving Average Convergence Divergence MACD is one of the most popular technical indicators used to generate signals among stock traders.

The purpose of this article is to provide a step-by-step process of how to automate ones algorithmic trading strategies using Alpaca Python and Google CloudThis example utilizes the strategy of pairs tradingPlease reference the following GitHub Repo to access the Python script. MetaTrader module for integration with Python. Installing the python-binance library.

It contains multiple libraries for machine learning process automation as well as data analysis and visualization. Table of Contents show 1 Highlights 2. We are democratizing algorithm trading technology to empower investors.

You can use the library locally but for the purpose of this beginner tutorial youll use Quantopian to write and backtest your algorithm. Although the initial focus was on backtesting paper trading is now possible using. QuantConnect provides a free algorithm backtesting tool and financial data so engineers can design algorithmic trading strategies.

Calls can be made in any language that supports a standard HTTP. Successful Algorithmic Trading Updated for Python 27x and Python 34x Forex Trading Diary 6 - Multi-Day Trading and Plotting Results Bayesian Inference of a Binomial Proportion - The Analytical Approach. The lastest is Python for Algorithmic Trading OReilly 2020.

Developers and investors can create custom trading applications integrate into our platform back test strategies and build robot trading. Before you can do this though. Integrating this signal into your algorithmic trading strategy is easy with Python Pandas and.

PyAlgoTrade is a Python Algorithmic Trading Library with focus on backtesting and support for paper-trading and live-tradingLets say you have an idea for a trading strategy and youd like to evaluate it with historical data and see how it behaves. Open source software. The easiest way to install the python-binance library is to use pip.

The second is Derivatives Analytics with Python Wiley Finance 2015. You can use a lot of technical indicators and Ta-Lib. We recommend storing your API keys as environment variables.

Every piece of software that a trader needs to get started in algorithmic trading is available in the form of open source. You can get 10 off the Quantra course by using my code HARSHIT10. Risk management is another extremely important part.

Pandas can be used for various functions including importing csv files performing arithmetic operations in series. This code is intended as a starting point for finding technical patterns it is for educational purposes only. Alexander started his career in the traditional Finance sector and moved step-by-step into Data-driven and Artificial Intelligence-driven Finance roles.

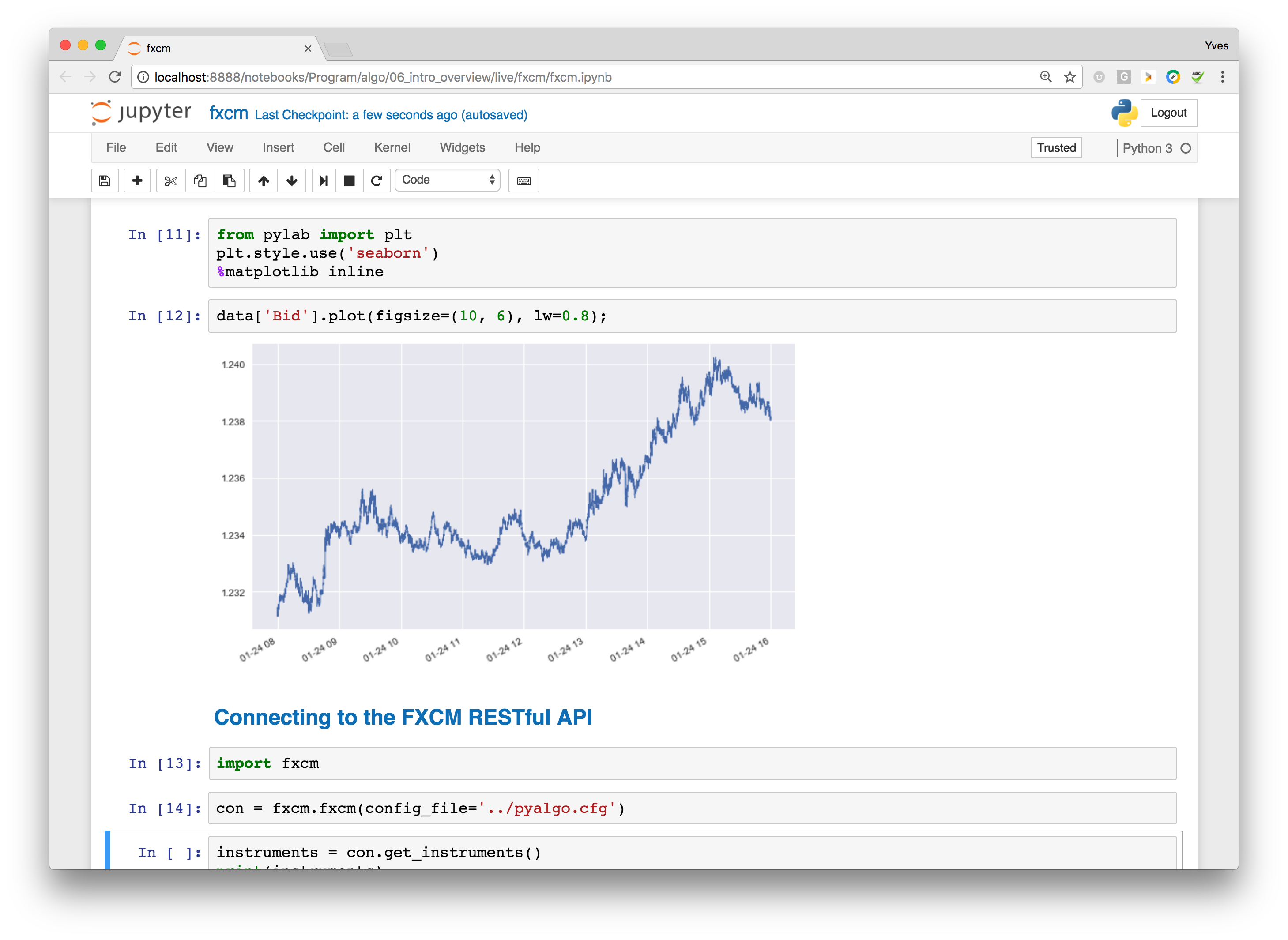

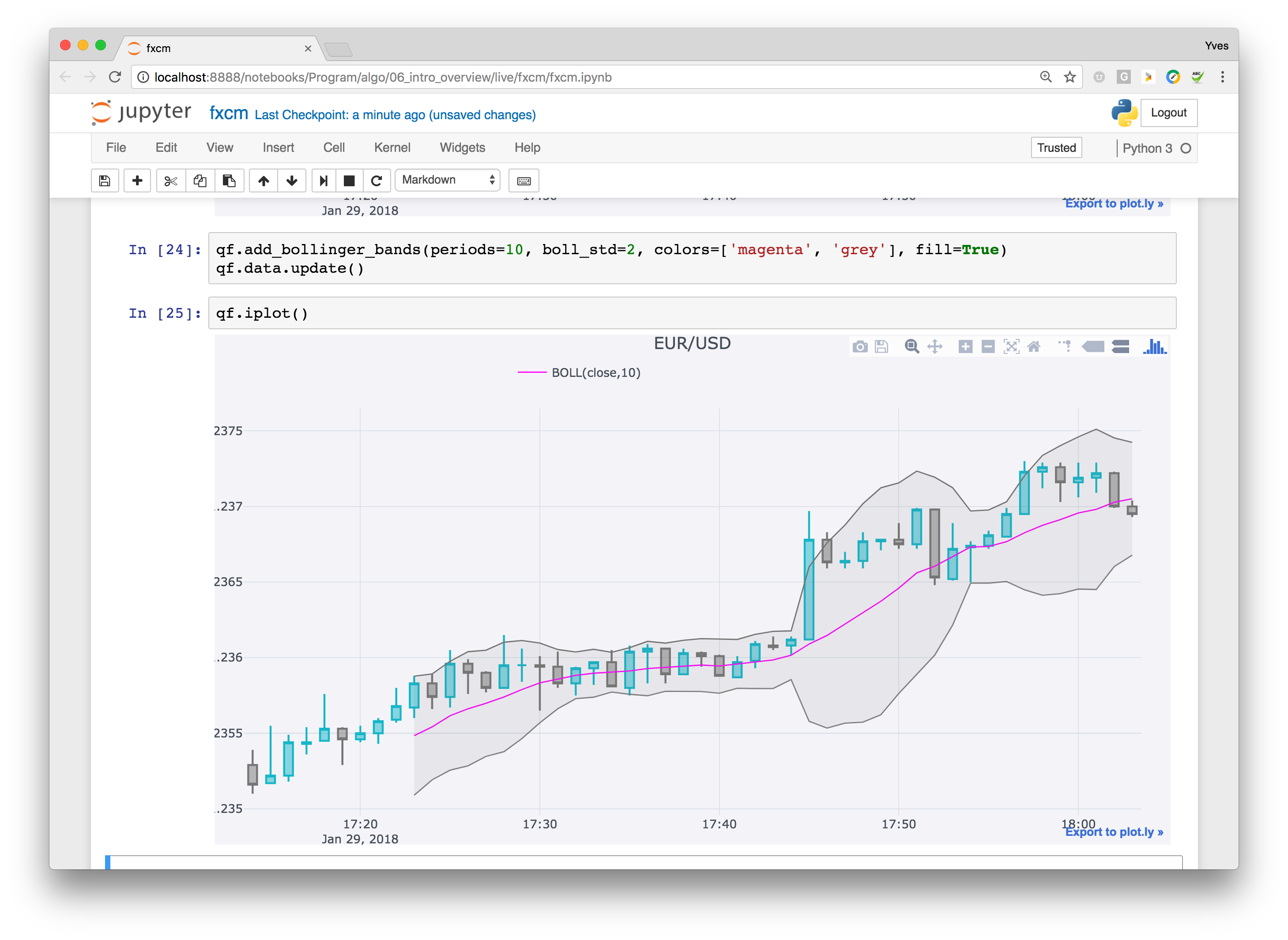

REST Representational State Transfer API is a web-based API using a Websocket connection that was developed with algorithmic trading in mind. Below youll find a curated list of trading platforms data providers broker-dealers return analyzers and other useful trading libraries for aspiring Python traders Ive come across in my algorithmic trading journey. Python is a modern high-level programming language for developing scripts and applications.

Its powered by zipline a Python library for algorithmic trading. Algorithmic trading strategies involve making trading decisions based on pre-set rules that are programmed into a computer. The third is Listed Volatility Variance Derivatives Wiley Finance 2016 followed by Artifical Intelligence in Finance OReilly 2020.

Quantopian is a free community-centered hosted platform for building and executing trading strategies. - Python for Business and Finance - Algorithmic Trading. Pip install python-binance Securing your API keys.

Rapid increases in technology availability have put systematic and algorithmic trading in reach for the retail trader. A trader Six Essential Skills of Master Traders Just about anyone can become a trader but to be one of the master traders takes more than investment capital and a three-piece suit. Backtrader is a trading and backtesting tool that supports an event driven algorithmic trading with Interactive Brokers Oanda v1 VisualChart and also with the external third party brokers alpaca Oanda v2 ccxt.

Specifically Python has become the language and ecosystem of choice. More and more valuable data sets are available from open and free sources providing a wealth of options to test trading hypotheses. The following code can easily be retooled to work as a screener backtester or trading algo with any timeframe or patterns you define.

A frequently rebalanced portfolio will require a compiled and well optimised matrix library to carry this step out so as not to bottleneck the trading system. Algorithms are a sequence of steps or rules designed to achieve a goal. From the command line simply type.

They can take many forms and facilitate optimization throughout the investment process from idea generation to asset allocation trade execution and risk management. Finance trading the stock market python computer programming A Python Beginners Guide Chapter is included algorithmsalgorithmic trading No Installs For Using Python Coding Environment.

8 Best Python Libraries For Algorithmic Trading Dev Community

Learn Algorithmic Trading With Python Jamal Sinclair O Garro 9781484249345

Algorithmic Trading Using Quantopian S Zipline Python Library In R And Backtest Optimizations By Grid Search And Parallel Processing R Bloggers

Algorithmic Trading Using Quantopian S Zipline Python Library In R And Backtest Optimizations By Grid Search And Parallel Processing R Bloggers

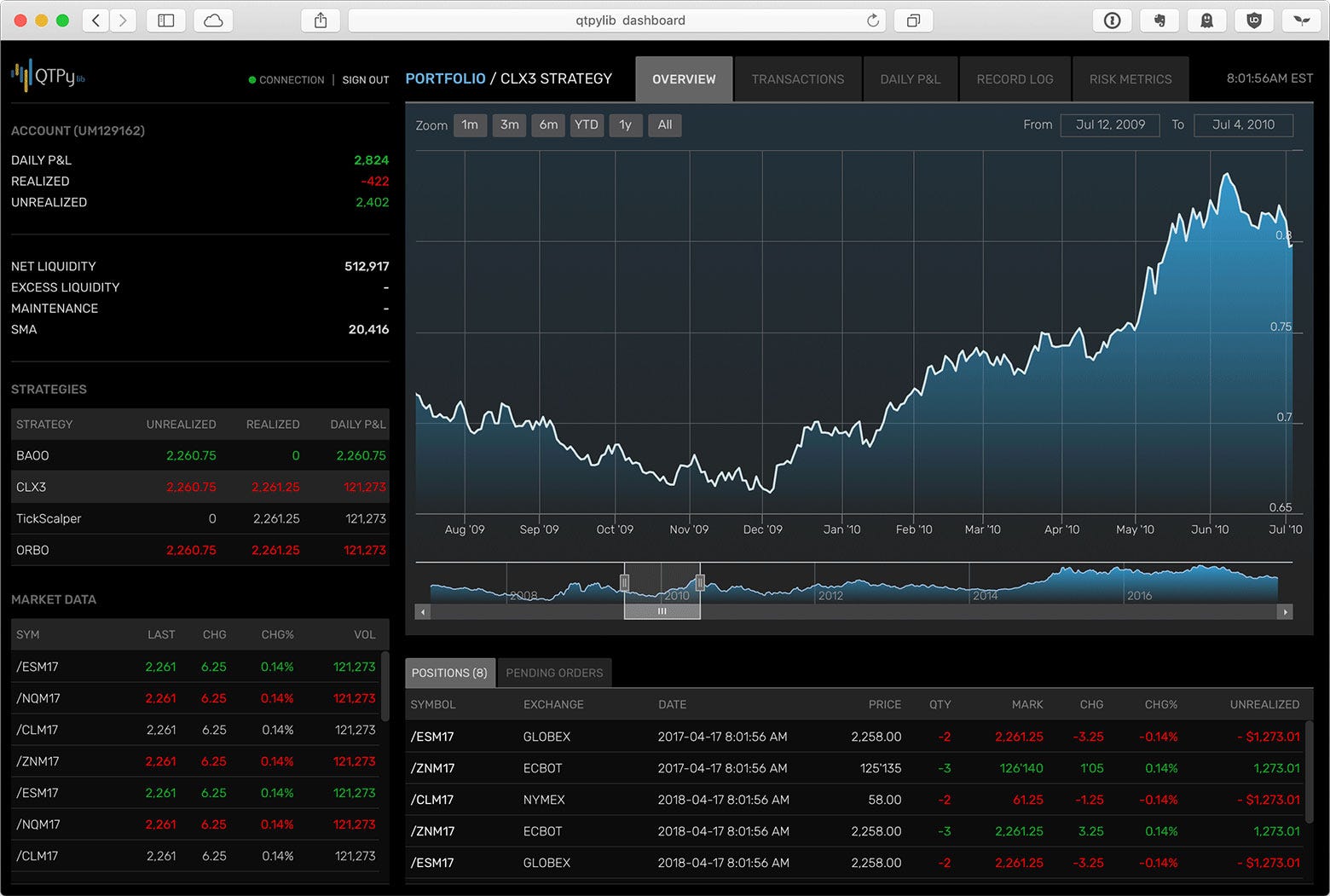

Github Ranaroussi Qtpylib Qtpylib Pythonic Algorithmic Trading

Algorithmic Trading Archives Pyquant News

Hands On Financial Trading With Python Packt

Algorithmic Trading With Python Chris Conlan

5 Most Popular Algorithmic Trading Libraries By Henri Blancke Icebergh Medium

Algorithmic Trading With Python How To Get Started Trality

Python For Finance And Algorithmic Trading Machine Learning Deep Learning Time Series Analysis Risk And Portfolio Management Quantitative Trading Ready To Use Included 1st Edition Inglese Lucas 9798485990381 Amazon Com Books

Python For Finance Algorithmic Trading Tutorial For Beginners

Why Python Is Used For Developing Automated Trading Strategy Geeksforgeeks

Amazon Com Algorithmic Trading With Interactive Brokers Python And C Ebook Scarpino Matthew Kindle Store

Algorithmic Trading Strategy Using Python Youtube

The Future Of Qtpylib My Python Library For Algo Traders By Ran Aroussi Medium

Python For Algorithmic Trading From Idea To Cloud Deployment By Yves Hilpisch

Komentar

Posting Komentar